Published on:

Reports that we are entering a “bear market” are highly exaggerated, suggests an economist who tracks real estate activity when commenting on the latest statistics from Northwest Multiple Listing Service (NWMLS). A director with the multiple listing service said the latest data may just reflect a typical August, noting activity tends to be slow as summer ends.

“Many may not remember August is usually a slow month because we were in a full-on sprint the last two years no matter which month it was. This may just be an adjustment back to normal,” said Jason Wall, designated broker and owner at Lake & Company Real Estate and a member of the Northwest MLS board of directors.

In a report summarizing August activity, Northwest MLS figures showed a continued buildup of inventory – nearly double the selection of a year ago and more than three times the offerings at the end of the first quarter.

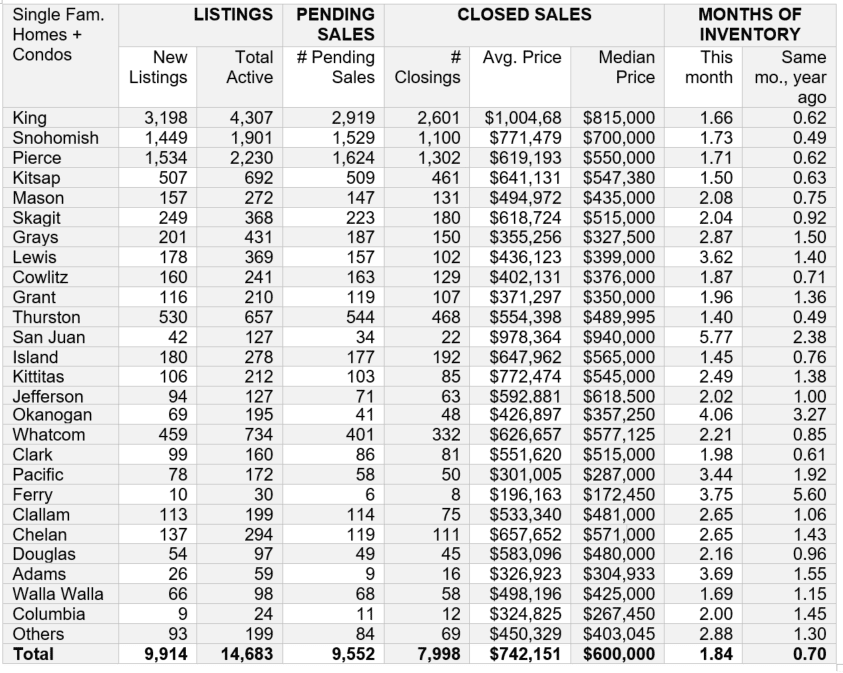

Brokers added 9,914 new listings to inventory during August, a drop from both July’s total of 11,805 and the year-ago total (11,437). At month end there were 14,683 active listings of single family homes and condominiums across the 26 counties in the NWMLS report.

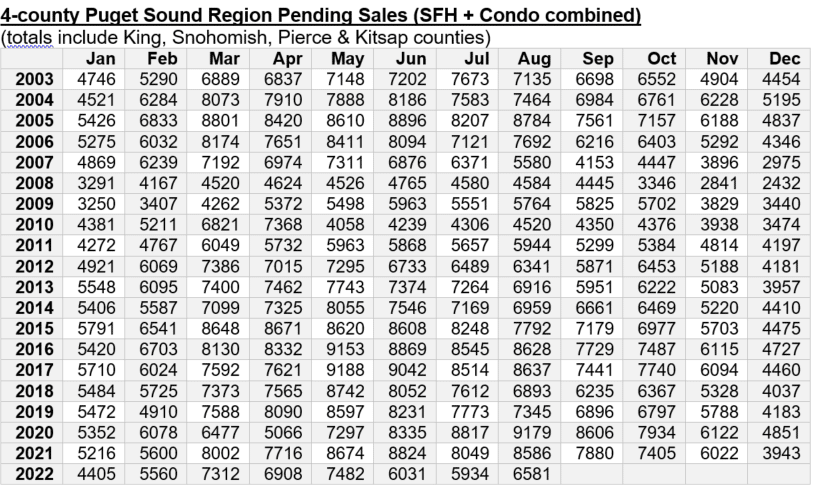

Fewer sales were reported than a year ago, but both pending sales (mutually accepted offers) and closed sales improved on July’s figures.

Northwest MLS members reported 9,552 pending sales, a drop of nearly 22% from the year-ago total of 12,238 pendings. Every county except Columbia experienced a decline in pending sales. Activity picked up from July when there were 8,775 pending sales, a gain of nearly 8.9%.

Similarly, the volume of closed sales fell from a year ago. MLS members recorded 7,998 completed transactions, improving 4.6% from July’s total of 7,645. But last month’s closings were down about 24% from the same month a year ago when members notched 10,571 closed sales.

“Last month’s housing numbers certainly are eye-opening,” stated Windermere Chief Economist Matthew Gardner. “However,” he continued, “I believe they are simply indicating the market is trending back to the more normalized conditions that we were seeing before the pandemic.”

J. Lennox Scott, chairman and CEO of John L. Scott Real Estate, commented on the local housing market’s resilience. “The resilience is clear as a steady cadence of homes going under contract continues. In the more affordable and mid-price ranges, demand remains strong as buyers look to get settled before fall.”

Broker Dean Rebhuhn, owner at Village Homes and Properties, commented on inflation and pent-up buyer demand. “Buyers are realizing homeownership is a good hedge against inflation,” he remarked. “The market took a slight pause as mortgage rates increased from historic lows. Then, as sellers came to the market with realistic pricing, and price reductions on existing inventory occurred, pent up buyer demand took effect and buyers found homes they could afford.”

Rebhuhn also noted last month’s sales showed home values continue to appreciate.

The median price on sales of single family homes and condos that closed during August was $600,000, up more than 3.6% from a year ago, but down slightly from July when the area-wide price was $625,000.

For single family homes, year-over-year (YOY) prices rose about 4.2%, from $600,000 to $625,000. Homes in San Juan County registered the steepest jump, climbing from $800,000 to $995,000 (up nearly 24.4%).

A comparison of the four counties in the Puget Sound region shows year-over-year median prices for single family homes increased from 5.9% in King County to 9.2% in Kitsap County.

Within the six sub-areas on the report for King County, North King County notched the largest YOY gain on single family home prices at 11.5%, followed by the map areas within Seattle (5.9%), Southwest King County (4.1%), the Eastside (about 3.9%), and Southeast King County (nearly 3%). Prices fell 11.3% on Vashon compared to a year ago.

Condo prices system-wide rose 3.3% from twelve months ago. Across all counties, the median price rose from $435,625 to $450,000. In King County, where nearly 60% of condo sales occurred, the median price increased 5.9%, from $458,000 to $485,000.

A check of the sales price to list price ratio shows an area-wide ratio of 99.3%. In three counties – Pierce, Thurston and Douglas – sellers received slightly more than their asking price. In ten other counties, the ratio was between 99.1% and 99.9%.

Economist Gardner expects prices will soften. “Home sales increased month-over-month, but the rise in listings is causing prices to soften,” he remarked, adding, “I predict prices will drop further as we move into the fall, but reports that we are entering a “bear market’ are highly exaggerated. The market is simply reverting to its long-term average as it moves away from the artificial conditions caused by the pandemic.”

Commenting on the uptick in inventory, Gardner said, “Even though inventory in the King, Pierce and Snohomish counties region almost doubled from a year ago, the number of homes for sale is still 14% lower than in August of 2019.”

Wall and Scott also commented on the jump in inventory.

Scott expects only two more months this year will have an increased selection of new resale listings coming on the market. “Once winter hits, new resale listings will become scarcer until activity ticks up to a higher level in March 2023,” he stated.

Wall also believes inventory will grow, saying, “I expect we will see even more inventory as we move out of the summer and into fall. Sellers will need to be more realistic about pricing and follow the advice of their broker regarding preparation of the home and positioning in the market. Buyers will have more inventory to look at and the longer market times may give buyers some leverage that they have not had in the past few years.”

John Deely, executive vice president of operations at Coldwell Banker Bain, also anticipates a more balanced market. “With continued building of inventory and fluctuating yet rising interest rates in July, we were on a trend toward a more balanced market. This seems to have cooled slightly as active inventory dropped from July to August. And, with less than two months’ inventory, we are still very much in a seller’s market.”

Commenting on prices, Deely reports increased competitiveness. “With the increase in median price slowing down to single digit percentages for the last two months, we are also seeing some competitiveness in pricing. Sellers are closely watching the market and pricing competitively to get their property sold. The increase in market time reflected in the months of inventory is due to sellers who are not pricing accurately, so their homes are sitting on the market longer.”

Despite the surge in inventory, the Northwest MLS report shows there is only 1.84 months of supply – and that’s down from July’s figure of 2.01 months. Only six counties had more than three months of supply: Adams, Ferry, Lewis, Okanogan, Pacific, and San Juan. Most industry analysts consider four to six months of inventory to be a balanced market.

“Buyers have taken a beating the last few years,” said Wall. “A move to a more balanced market will likely encourage buyers that stopped looking to rethink the idea and return. Even if interest rates are higher the continued rise in rent expense still makes owning a home an attractive idea.”

Lawrence Yun, chief economist at the National Association of Realtors®, believes “we may be at or close to the bottom in contract signings” for the current housing cycle. He noted housing affordability plummeted to its lowest level since 1989, in part due to rising mortgage rates and prices, but he expects annual price appreciation to moderate “to the typical rate of 5% by the end of this year and into 2023.”

Continuing the optimistic outlook, Yun stated, “With mortgage rates expected to stabilize near 6% alongside steady job creation, home sales should start to rise by early next year.”

About Northwest Multiple Listing Service

As the leading resource for the region’s residential real estate industry, NWMLS provides valuable products and services, superior member support, and the most trusted, current residential property and listing information for real estate professionals. NWMLS is a member-owned, not-for-profit organization with more than 2,500 member offices and 30,000+ real estate brokers throughout Washington state. With extensive knowledge of the region, NWMLS operates 18 service centers and serves more than 26 counties, providing dedicated support to its members and fostering a robust, cooperative brokerage environment.

NWMLS now offers a home listing search and comprehensive broker database at https://www.nwmls.com.

Other resources: